Alexa von Tobel is a full-time investor, the founder and managing partner of Inspired Capital and author of the New York Times bestselling book Financially Fearless. She’s also a mother of three—two daughters and one son—and perhaps unsurprisingly, she started sharing financial wisdom with her kids not long after they could walk.

Now, von Tobel is helping set other parents and their children up for financial success with a new children’s book, Money Matters: A Guide to Saving, Spending, and Everything in Between, published by Rebel Girls.

“I very much wrote this as a fellow parent trying to do my part to empower parents everywhere,” she says. The book is an in-depth guide to earning, saving, spending and everything in between, from creating a budget to getting started with investing to starting your own business.

The pages are full of colorful illustrations of girls chowing down on pancakes and dumping out their piggy banks, but the advice in here isn’t watered down; this is a practical, real-world look at financial planning from a certified financial planner (or, as von Tobel introduces herself in Money Matters, “basically a doctor of money”).

Like so many things in life, when it comes to talking with kids about money, Alexa von Tobel says it’s not about what you say so much as how you say it.

Use the right tone and language when talking about why money matters with kids

“Tone is the most important thing I want parents to focus on,” she says, referring to a University of Michigan study that found the tone you use around money can influence children as young as 5. “Meaning that by age 5, the tone of how a house operates around money does have a pretty sizable impact on how the child manages and thinks about money in their life going forward.”

Alexa Von Tobel encourages parents to speak about money in a positive way. Even when financial matters around the house might be stressful, as they often can be, it’s important to not let that negativity seep into conversations your child can hear. She suggests keeping it as matter of fact as possible, and talking about money “in a way that is very can-do,” with clear and straightforward statements like, “money is manageable,” “I can be strong with my money” and “money is something I can handle.”

That focus on tone should also be applied when you talk about earning money—in other words, how you talk to your kids about work. If you’re making a habit of speaking about your job negatively, saying things like, “Ugh, work is awful, I hate it, but I have to leave you and go to work,” your child is internalizing a simple message: Work is bad.

That’s not setting them up for success, von Tobel explains, since just about everybody needs to work to pay their bills. She makes sure to discuss work in a way that is positive and in terms they’ll associate with fun. For example, “Hey, you know how you like doing puzzles and you have fun doing puzzles? Mommy loves puzzles… but her puzzles are bigger, and they involve building companies and working with people and solving big challenges.”

Make saving and spending money easy for kids to visualize

Visual tools can be incredibly effective for younger kids who are just beginning to learn about how money works. Alexa Von Tobel’s kids have three piggy banks: a huge one, which is for college savings, a medium-sized one, which is for bigger items they might want to save up for, like a bike, and then a much smaller one, which is for everyday treats and purchases. The idea is that they can see, with their own eyes and not in some abstract way, that bigger purchases will require them to save more money, and that the money they squirrel away in their banks actually will add up.

“And they get it: ‘The big one, I need to fill more into that one,’” she explains. “It’s a visual representation.”

Not long ago, she found herself in a situation many parents and their kids end up in. They were at Target, and her daughter, then age 4, really wanted a toy; von Tobel was not going to buy it. They were at an impasse until von Tobel held her arms out wide—a visual aid—to indicate the number of quarters it would take to purchase the toy, which was more quarters than she had at the moment.

“We had a moment where she actually relented and was like, ‘OK, Mommy. I understand.’ I realized it’s about using visuals so that they understand how big the amount of money is, or how expensive something is. It helps them appreciate it; they can take the ‘no’ better,” von Tobel says.

Use tangible money to teach financial literacy for kids

Our money may be more virtual than physical these days, but von Tobel also suggests going to the bank and taking out different bills and coins. Using physical money is a way to hone their math skills, and seeing the actual dollars and cents can help kids understand what money actually is.

When they get a little older, go ahead and open a bank account for them, and show them those numbers! (Though it can help to stress: These are private numbers for our family to know.) Letting kids see their money and being able to watch it grow can be a powerful thing, and it helps emphasize that saving, especially for big things like college, is hard work—that money doesn’t just appear out of thin air, and you have to be committed to saving it over the course of years.

When to introduce more complex financial topics to kids

Of course, different financial concepts will make sense at different ages—your 5-year-old might understand being strong with money better than interest rates—so when does it make sense to start introducing some of those more complicated financial factors?

According to Alexa von Tobel, “As soon as second grade, when kids are learning the basics of math, addition and subtraction, they are intellectually capable of learning all about the big parts of money.” As early as age 8, 9, 10, a child can grasp the most important principles of money: saving, investing, borrowing, compounding interest.

And as your kids grow, the conversations around money will continue to evolve. If your child has an entrepreneurial spirit, for example—perhaps they’ve started a lemonade stand or they sell bracelets, like one of von Tobel’s daughters does—there are additional ways you can set them up for lifelong financial success.

“Here’s my biggest, most powerful piece of advice: As soon as your child starts earning money… that money can actually go directly into a Roth IRA for retirement,” she says. “You’re basically giving your child an extra decade of retirement investing, which is incredibly important.”

This has to be external money your child earned—it can’t be allowance money—but you’re able to open a Roth IRA for them, and they can make small deposits as their business grows.

In Money Matters, von Tobel even has empowering advice for discussing less feel-good aspects of our financial world with your kids—for example, the pay gap. Rather than focusing on pay inequity, she manages to turn even this into a positive: Your work is important, and you are equal.

“It’s a simple concept, but the fact that your work is equal at all times… it’s just a powerful framing,” she says. “It doesn’t matter who else is around you, in all shapes and sizes, your work and your effort is equal to everyone else’s.”

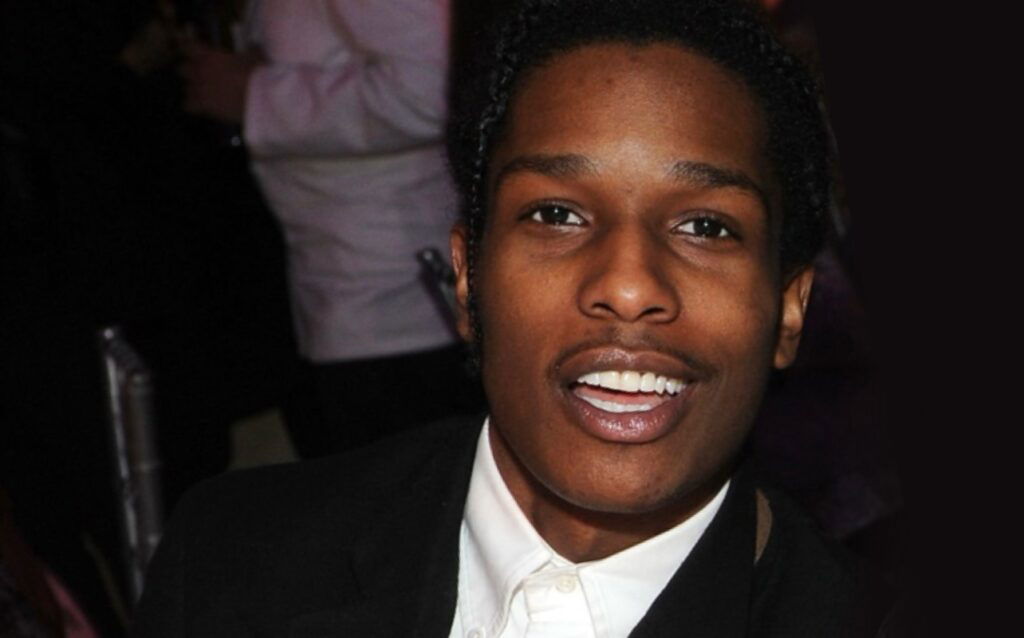

Photo courtesy of Alexa von Tobel.