When a “once-in-a-century” flood left the facilities of Maine-based snack company Better With Buckwheat (BWB) under 4 feet of water the week before Christmas last year, CEO Lewis Goldstein had his work cut out for him.

The company was closing out its best year in business when the flood struck on Dec. 18, 2023. “Personally, it took a toll on me,” Goldstein admits. “We tripled our revenue in ’23. We had thousands of dollars of orders left to go out in December [and] had such a strong momentum going…Then to have it just stop…[was] tough.”

Known locally as the “Grinch Storm,” the torrential rains that blew out electricity and heat across Maine resulted in flooding over the course of several days. BWB is situated on a river, which Goldstein says rose more than 25 feet and inundated their facility.

Adding insult to injury, the BWB facility was new—the company had just taken over the industrial space and embarked on a rebuild. They’d only been working there since September 2022, with plenty of new equipment and refurbished walls, floors and installations.

The government declared a state of emergency. Goldstein and company couldn’t enter the BWB facility for six days until utilities and electricians determined it was safe. When they entered, they found they’d lost the majority of their ingredients and most of their stock, including all their finished goods and packaging.

“We didn’t know at that point how long we were going to be out of commission,” Goldstein recalls. The company offered employees two weeks of pay, which gave them time to sign up for unemployment and avoid any unpaid time over the holiday season. They set a date to try to reopen by Jan. 22, 2024.

BWB hit that target and began producing again on Jan. 24, 2024. When Goldstein spoke with SUCCESS® in late March, he said the facility was back to working at about 90% capacity: “We’re finishing the final touches on putting the building back together as we speak.”

Goldstein’s experience holds valuable lessons for others, especially as natural disasters like the “Grinch Storm” are occurring more frequently now than ever.

Enlist others for emergency business plan advice

When news of the flood hit, Goldstein immediately reached out to others for advice. He says he talked with one of the company’s board advisers who had gone through a fire disaster at a food company, and he spoke with others who had experienced floods.

Their first point of advice was to get the disaster recovery team in as quickly as possible, start cleaning up the facility and worry about insurance policies and money later. “You can’t wait for the insurance adjuster, and the people I called told me to just do it and figure out the money later. That was smart advice.”

BWB brought in a disaster mitigation company to assess and address damage. An industrial-strength dryer worked at getting back up to FDA standards for moisture in the air and a workforce was assembled to clean everything and demolish walls to take out insulation where mold might grow.

The other key piece of advice Goldstein received was to “over-communicate, over-communicate, over-communicate”—with retailers, distributors, suppliers, employees, investors, customers, anyone and everyone. “People are going to be understanding of the situation you’re going through as long as they’re kept up to date.”

One of BWB’s key accounts, Whole Foods, for example, was “very understanding,” in Goldstein’s words. “As soon as we didn’t have any more stock, they said, ‘We’ll put a temporary ‘out-of-stock’ and as soon as you have product, it’ll go right back on the shelf.’”

Create strong relationships with other businesses

For Goldstein, Whole Foods’ reaction was one of several insights he had over the course of the disaster into just how crucial relationships are for any business, but especially in an emergency. BWB was started by a local family and is based in rural Maine. The company’s founders live just a few miles away, and their daughter works for BWB.

Goldstein notes that many local partners have watched BWB grow and have grown alongside them. But what he found after the flood was that local and non-local business partners alike were supportive. “It didn’t take much more than asking for them to say, ‘How much time to you need?’”

“It ingrained in me even more that if you have a relationship that’s not great… do something about it before you are in a situation where now you don’t have anyone to call.” He refers to these invested relationships as “intangible equity.”

Businesses might be tempted to change partners regularly “to save a penny or two,” he says, but in a disaster, you need deeper ties and partners with built-up goodwill who will give you a break “so you can get back on your feet.”

“Make sure you have a really strong relationship with your electrician, your plumber and those core service providers. Because in a disaster, everyone’s going to be calling them, and if you haven’t had a good relationship, if you haven’t paid them on time, if you haven’t been a good partner, you’re not going to be at the top of the queue.”

BWB got back on its feet with help from many partners, including employees. Goldstein describes how staffers came down to the facility unprompted to pitch in with cleanup. “They also wanted to see the business recover—both for the job and because you have a sense of community. When you see something destroyed, there’s a natural sense to want to see it be built up again and be part of that.”

Make sure you understand your business insurance policy

As BWB assessed water damage to machines and installations, Goldstein says he wasn’t sure what would and would not be covered by insurance. He jokes he had an “MBA course in insurance coverage and insurance companies” in figuring out the firm’s various policies and juggling multiple insurance adjusters.

He recalls this as one of the most stressful parts of the whole process, and his top piece of advice for others is to get counsel on insurance coverage from owners of similar businesses. “If I had to do it all again, knowing what I know now, I would have gotten much, much more into our insurance when I took over as CEO.”

“You have to understand all the fine print of your insurance and go through your facility with your insurance broker. Make sure everything that you want covered is covered. Know what are the exceptions to that coverage, and are there other coverages you can buy to cover those exceptions.”

It’s also crucial to keep your policies constantly updated, he says. Be prepared for a disaster of any kind and ensure your coverage grows as your business grows or your inventory grows. Each time a new piece of equipment enters your facility, get it added to the policy.

After the flood, “We had to order all new stuff and do that without having the insurance money come in. Thankfully, we try to work with as many local businesses as we can, and those businesses were understanding about giving us a considerable amount of extra time to pay them.”

Goldstein says he anticipates 70% of the company’s losses from the flood will be covered by insurance, and he’s hoping state relief funding will cover the rest. But, he notes, with proper insurance coverage, a company can and should be 100% covered in a disaster like the Grinch Storm.

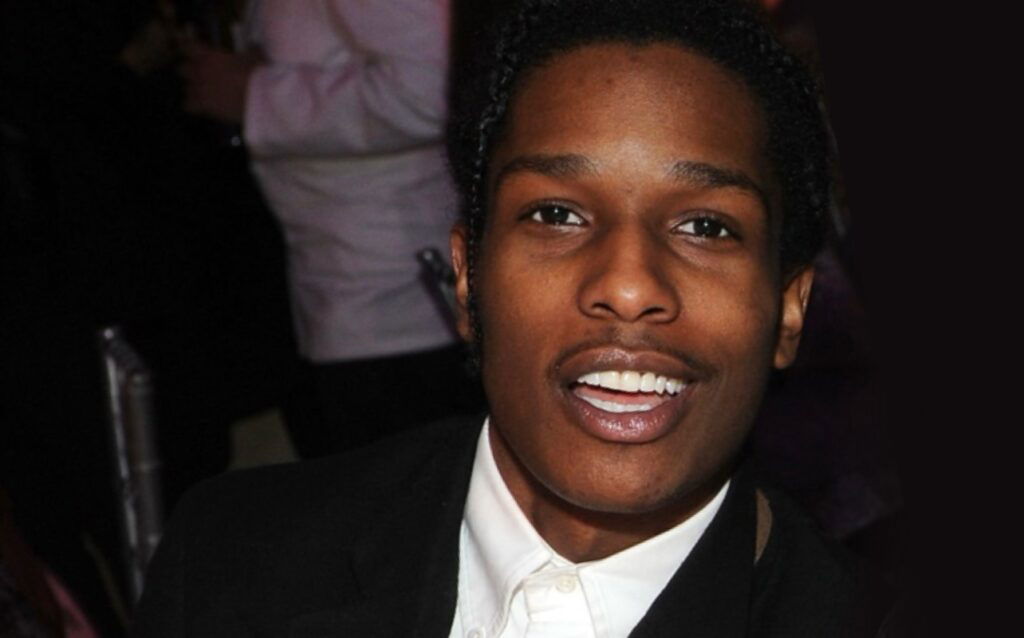

Photo by Jon Rehg/Shutterstock.com