Practicing financial wellness starts by understanding how you spend your money. But without the right tools, tracking every purchase can feel tedious. That’s where the Rocket Money app comes in. Formerly known as Truebill, this popular money management app has helped over 5 million members improve their financial well-being. With its user-friendly interface and intuitive design, Rocket Money makes it easy to manage your money. It has a feature-rich platform that includes credit score tracking, subscription management, budgeting and more.

Learn how Rocket Money empowers users to take control of their financial health and find financial freedom and how you can take the next step to see if this tool is right for you.

The Rocket Money App: Pros And Cons At A Glance

The Rocket Money app has plenty of powerful features for financial wellness, and it’s easy to see why this tool is so popular. We’ve rounded up the pros and cons for a quick overview:

Pros:

- Intuitive design

- Available on iPhone and Android

- Connects to all bank accounts, credit cards and investment accounts

- Bill negotiation feature

- Subscription tracking and canceling feature

- Budget creation feature

- Free plan available

- Safety (256-bit encryption, which is what many banks use)

Cons:

- Limited features with free plan

- Weak investment tracking capabilities

- Bill negotiation is expensive

Key Features And Benefits Of The Rocket Money App

According to a recent survey conducted by Self Financial, the average U.S. household wastes $32.84 monthly on unused subscriptions. Over the course of a year, that’s almost $400. That’s no small amount of change. Rocket Money, however, helps users save on unused subscriptions and more through its unique features. In addition to its powerful subscription management, the app’s features also include bill negotiation, expense tracking and budgeting, financial health monitoring and savings goals with automation.

How To Use The App

Ready to get started? It’s simple. Once you’ve downloaded the tool, simply connect your bank accounts and credit cards securely through Plaid to use the app. This allows the app to analyze your transactions. You can begin managing your money and tracking your financial health from there. The app is available for multiple devices. Find Rocket Money on Google Play or Rocket Money on the App Store.

Pricing Structure

Rocket Money is committed to helping its users find financial self-empowerment, which is why it offers a free version of the app. To access enhanced budgeting features, you can sign up for a premium membership. While the prices vary slightly, generally, premium members can choose to spend between $6 and $12 monthly.

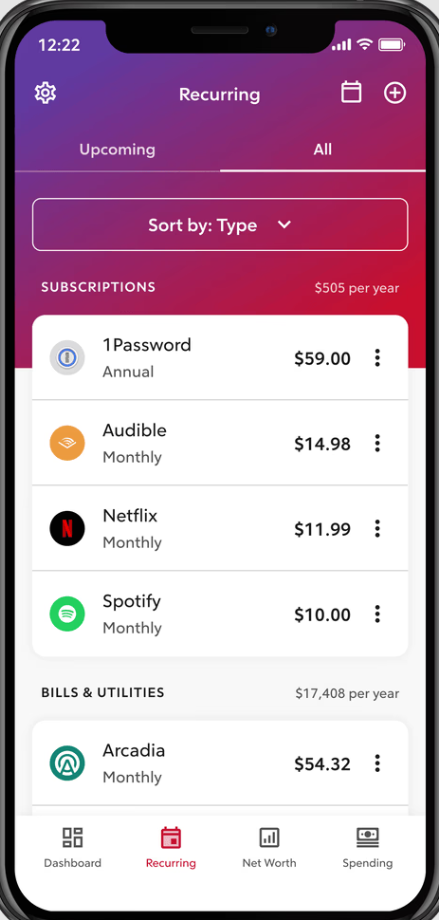

Subscription Management

Rocket Money has canceled nearly 2.5 million subscriptions on behalf of its members, saving users money and reducing subscription clutter. The app identifies recurring charges and highlights subscriptions you may have forgotten. If you come across a subscription you’re no longer using, the app offers a concierge service to handle the cancellation on your behalf, saving you time. Rocket Money also shows your upcoming bills, helping you pay on time and avoid late fees.

Bill Negotiation

Rocket Money’s bill negotiation feature saves you money by securing better bill rates. Just connect your bills, and the app’s team will work to lower costs of monthly expenses like cell phone bills and car insurance. If the negotiation is successful, you’ll get charged a fee ranging from 35% to 60% of your first year’s savings, with the choice of percentage up to you. Plus, if your bank ever charges you overdraft or late fees, Rocket Money helps you get those refunded, keeping your finances in check.

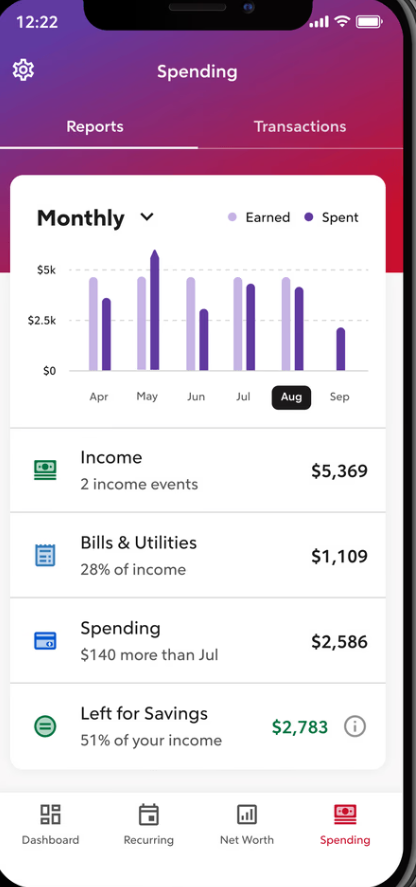

Expense Tracking And Budgeting

Creating a budget is often the first step toward financial freedom, but manually tracking every grocery run or Amazon purchase takes time and effort. Rocket Money simplifies this process by automatically monitoring and categorizing your spending, helping you stay on track with your financial goals. The app analyzes your transactions to calculate your monthly spending allowance, making it easier to understand how much you can afford to spend. You can also create personalized goal trackers for specific categories. To ensure you never overspend, Rocket Money alerts you when you’re nearing your spending goals.

Financial Health Monitoring

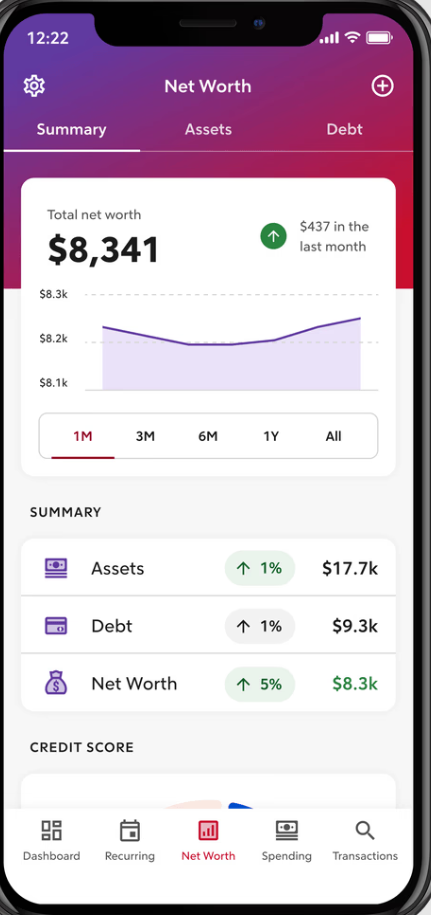

Financial health impacts everything from your ability to handle unexpected expenses to planning for retirement. For most people, economic well-being is a lifelong journey that requires constant monitoring to ensure you’re on track. The Rocket Money app provides a wholistic view of your financial health by monitoring your credit score and tracking your net worth. The app alerts you to important changes that could impact your credit score and provides insights to help you understand what those changes mean. Additionally, Rocket Money allows you to track everything you own and owe in one place, offering typical categories like a 401(k) and the flexibility to add custom ones.

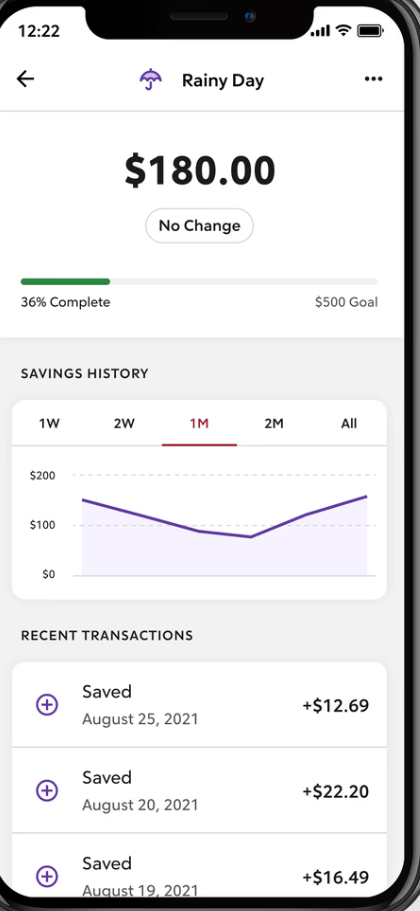

Savings Goals And Automation

Whether you want to purchase a home or simply save for a rainy day, Rocket Money makes saving effortless. The app analyzes your accounts to determine the best times to save, helping you reach your goals faster and avoid overdraft fees. You can set a savings goal, choose your preferred deposit frequency and watch your savings grow. All deposits are kept in your account with Rocket’s FDIC-insured banking partner, ensuring your money is secure. Plus, you have complete control over your savings—you can edit, pause, withdraw or close your account anytime.

How Can Rocket Money Help With Your Self-Improvement Goals?

If your self-improvement journey includes better financial planning, budget tracking and saving money, the Rocket Money app can help.

It Enhances Your Financial Awareness

Financial self-empowerment starts with financial awareness. However, over 50% of Americans don’t use a budget or know how much they spend monthly. This lack of knowledge can quickly lead to overspending and debt accumulation. The Rocket Money app helps users keep track of their spending habits and patterns, encouraging them to make better financial decisions.

It Drives Goal Achievement And Promotes Accountability

Research shows that setting financial goals is the key to successfully saving money. Rocket Money helps support your success by allowing premium members to set financial goals within the app. To help keep you accountable, the app offers goal-tracking features that let you monitor your progress, adjust targets as needed, and stay motivated. You can stay accountable through community support, celebrate financial wins and achieve savings goals with ease.

It Helps You Stay Consistent With Money Management

One of the most challenging aspects of any habit, including better spending and money management habits, is being committed to your change. The Rocket Money app can help you stay consistent and follow through with your commitment to better financial wellness and a stronger financial future.

Rocket Money Customer Reviews

With an average of 4.4 out of 5 stars on Trustpilot, most Rocket Money users were pleased with their experience. Many praised the app for offering so many money management features in a single app, with one user saying it’s “like having a personal accountant.” Others noted that the app makes budgeting much more manageable, helping them save more money than they previously had. Reviews were mixed on Rocket Money’s customer service, but users seemed generally happy with the help they received. While the main population of users is adults in their 20s and 30s, anyone can benefit from using the app.

Alternatives To The Rocket Money App

While Rocket Money is a favorite finance tool among many users, there are many other financial management tools available for personal and professional use. Tools like Honeydue, Empower Personal Dashboard, and YNAB are all great alternatives for Rocket Money. However, they may offer different features than the Rocket Money app. Trying out the top finance apps can help you evaluate which one works best for you.

Take Control Of Your Finances

Financial wellness starts with tracking your money, and thanks to technology, it’s easier than ever before. The Rocket Money app supports your journey to financial freedom by simplifying expense tracking and monitoring your savings goals. Download the Rocket Money app today to check out the features and benefits for yourself. When you take control of tracking and managing your money, you’re taking the first step toward financial self-improvement.

FAQs

Who Is The Rocket Money App Designed For?

Rockey Money is designed to help people take charge of their personal finances. While it’s accessible to a wide range of users, its largest demographic is U.S.-based individuals ages 23 to 34+.

What Makes The Premium Membership Unique?

Premium Rocket Money members gain access to a wider range of features than those with the free membership. Premium features include:

- Unlimited budgets

- Full credit reports

- Cancellation services

- Net worth tracking

- Smart savings accounts

- Real-time syncing

- Transaction management

- Account sharing

- Data export

What Features Are Included In The Free Membership?

While the free membership doesn’t offer as many features as the premium membership, you can still access a few helpful financial tools. Free features include the following:

- Account linking

- Balance alerts

- Subscription management

- Spend tracking

Photo by David MG/Shutterstock.com