A record multi-million dollar gift to Florida A&M University (FAMU) was voided in May, an independent investigator said on Thursday, as a third-party report determined school officials failed to vet a “fraudulent” contribution and that the donor’s self-valuation of his fledgling hemp company was “baseless.”

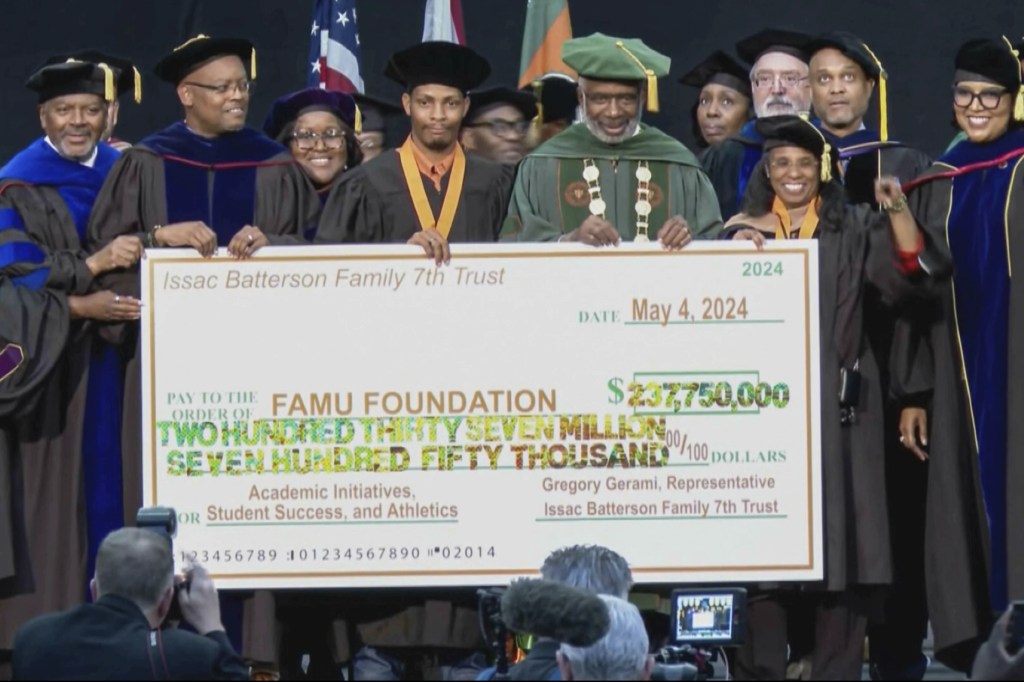

The $237 million donation from Gregory Gerami, a little-known entrepreneur, was “invalidated” because of procedural missteps in a move that came came ten days after FAMU revealed the large gift at its graduation ceremony, investigator Michael McLaughlin told trustees. FAMU is the lone public historically Black university in Florida.

Gerami violated his equity management account’s terms by improperly transferring 15 million stock shares in the first place, according to an Aug. 5 report by the law office of Buchanan Ingersoll & Rooney, PC. When the company terminated Gerami’s contract on May 14, McLaughlin said, any stock certificates in FAMU Foundation’s possession were cancelled.

What’s more, the foundation never countersigned the gift agreement after both parties signed an incorrect version on the day of commencement.

Thursday’s meeting came three months after that celebratory affair. The university president posed onstage with a jumbo check alongside Gerami, who was invited to speak despite a documented history of dubious business ventures and failed higher education giving.

Things soon fell apart. After almost immediate public outcry, the school paused the gift and a vice president left her position. President Larry Robinson submitted his resignation last month.

Gerami, who founded Batterson Farms Corp in 2021, told The Associated Press that he had not read the full report. He agreed that his internal valuation “doesn’t carry any weight,” but said he obtained a third-party valuation after the debacle.

According to investigators, Gerami provided a FAMU Foundation official on June 28 with the first two pages of a valuation by Stonebridge Advisors Inc. The appraisal suggests Batterson Farms Corp is worth $9.93 per share — well below the $15.85 figure from the initial gift agreement.

Gerami declined to provide AP with any documents supporting this conclusion, saying, “You don’t need the full report.” He also denied that he improperly transferred company shares to the FAMU Foundation. He said he used “the process I have always followed.”

Millions intended for scholarships, athletics facilities, the nursing school and a student business incubator will not be realized. In their place are reputational damage and halted contributions from previous donors who assumed the university’s financial windfall made additional gifts unnecessary, according to the report.

The investigation blames administrators’ lack of due diligence on their overzealous pursuit of such a transformative gift and flawed understanding of private stock donations. Robinson repeatedly told staffers “not to mess this up,” according to investigators. Ignored warning signs alleged by the report include:

- An April 12 message from financial services company Raymond James revoking its previous verification of Gerami’s assets. In an email to two administrators, the firm’s vice president said that “we do not believe the pricing of certain securities was accurate.”

- “Derogatory” information discovered by the communications director as he drafted Gerami’s commencement speech. That included a failed $95 million donation to Coastal Carolina University in 2020. The report said the official “chose to ignore these concerns and did not report them to anyone else, assuming that others were responsible for due diligence.”

- An anonymous April 29 ethics hotline tip that the Texas Department of Agriculture could back up claims that Gerami is a fraud. The Office of Compliance and Ethics reviewed the tip but did not take action because the gift’s secrecy meant that the office was unaware of Gerami.

Senior leadership “were deceived by, and allowed themselves to be deceived by, the Donor — Mr. Gregory Gerami,” the report concluded.

“Neither Batterson Farms Corporation nor any of its affiliated companies had the resources available to meet the promises made in the Gift Agreement,” the authors wrote.