CaskX, which launched in 2020, is one of many new opportunities that embody how the face of investing has changed over time. The company offers investors a smooth way to grow their net worth by buying scotch and bourbon barrels directly from distilleries, letting them age and then selling them to buyers who don’t have the time to age their own products.

“It’s one of the few investments that has historically gone up in value regardless of market conditions,” says Jeremy Kasler, the company’s founder and CEO. Although millennials and Gen Zers are drinking less these days than their predecessors, people who are drinking are spending more on higher-quality products, he says. Generally, investors can expect to double their investments within about five years. But the longer they hold them, the more valuable they’ll be.

Expert advice on investment

The trick for distilleries, though, is that most don’t have the time or capacity to hold onto their barrels for three, six or 12 or more years. That’s where CaskX comes in as a neat middleman for distilleries in Scotland and the U.S. The company can facilitate product tastings to match investors with distilleries they trust to produce a good spirit. Then, CaskX takes care of the storage of the barrels until a buyer is found. They take a portion of the sales as a fee.

“We don’t just pitch the whiskey; we pitch the people behind it,” Kasler says. But CaskX is just one of the ways investing has gotten more personal over the past few years, as people have expressed more interest in investing in their interests and values rather than simple index funds. Even when it comes to more traditional stock investing, people want customized portfolios more than ever, says Dana D’Auria, co-chief investment officer and group president of Envestnet, which offers wealth management technology for financial advisers and enables them to customize portfolios more easily.

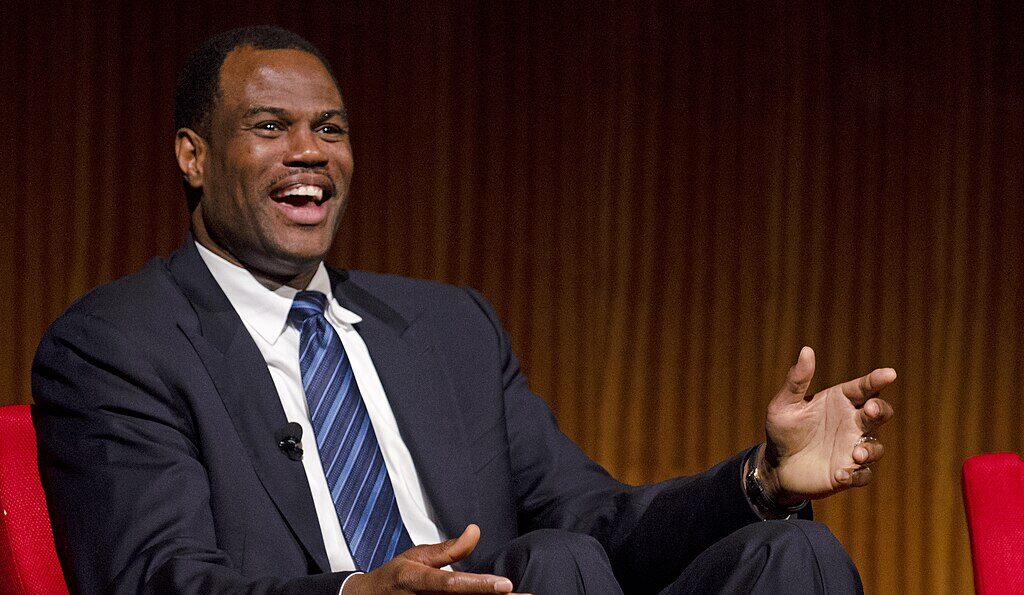

Just getting started with investing or think it’s time to restructure? Here’s some investment advice, according to D’Auria and Josh Crawford, vice president of training and development for Matson Money, which offers education for individuals and financial advisers.

Know your ‘why’ before you start moving your money

If you’re new to investing or considering a big change, take a moment to define why you’re investing before you get too deep, Crawford suggests. Matson Money specializes in investor education and offers a conference called the American Dream Experience to help people understand how to put their money to work for them. One of the first things they do is get people focused on their purpose.

Sure, making lots of money may sound great, but what are you going to do with it once you have it? Without a plan for that money, you may find it harder to work toward the goal or see it as a precious asset that isn’t worth risking. Similarly, you might also find it too hard or too easy to spend that money once you have it if it’s not earmarked for something specific.

“Once you have a purpose, it’s like, ‘OK, now I don’t want to gamble my money because I have a purpose for my money,’” Crawford says. “[Maybe] my purpose is that I want to live an adventurous life and leave a legacy. OK, great. Let’s not get on Robinhood and gamble that.”

Be wary—people are making more mistakes than ever

The advent of apps like Robinhood and Stash allow people to buy and sell fractional shares in virtually any amount. While these commission-free platforms democratize investing, allowing people to take their finances into the palms of their own hands, they also make it easier for people to lose, and to lose big, when they make a bad bet.

People clearly want more customization of their portfolios than ever before, but D’Auria says it’s hard to say whether putting investing directly in the hands of individual investors has been a boon or a bust. Sometimes, it works out great. Other times, apps like Robinhood enable people to engage in a “modern-day pump and dump” with meme stocks, like we saw with GameStop in 2021.

“There are more ways for people to make mistakes with their money now than ever before,” Crawford says. “I am very cautious when it comes to all these new apps, like Robinhood…. I think it confuses gambling with investing, and those are two completely different worlds for us.”

Crawford cautions prospective investors against picking individual stocks, timing the market or trying to predict which way it will go.

“Beware of anything that feels like betting,” he says, likening Robinhood to gambling and betting platforms like FanDuel. “If you do have the apps and it feels like you’re sports betting, that should be a red flag. Investing is not a get-rich-quick game. It’s a game that requires prudence and discipline over a lifetime.”

Investment tips: Think differently about going green

Crawford and D’Auria shared differing perspectives about trying to be ethical within your portfolio. Crawford says he thinks it’s not possible to “keep your hands clean” because everything is connected. Even the greenest companies employ people who drive cars to get to the office, he said, and they still use paper and electricity.

“Rather than basing your investment strategy off of your values, what we find is a better way to do it is to engineer a portfolio that can maximize your rate of return, and then with the returns that you get, give back to causes that you care about,” he says.

D’Auria approaches the question differently. The data is clear that your returns will go down if you simply remove “sin” stocks like alcohol and tobacco or if you try to divest from oil companies hurting the environment, she said. But the jury is still out on whether structuring your portfolio around highly sustainable companies may be a better long-term bet. If you focus on companies with environmental, social and governance initiatives, known as ESG, you could potentially come out on top in the long run, she said.

Companies with good governance may not have the sorts of management scandals that can tank an asset, and companies that are planning for a net-zero future may outlast those that can’t adapt to environmental challenges.

Get started right now

If you’re sitting on a pile of cash or if you have significant investment in just a couple of assets, Crawford and D’Auria agree that it’s worth taking some time immediately to address that. “The first step is to diversify,” D’Auria said. If you’re interested in focusing your portfolio on ESG companies, she recommends exploring thematic exchange-traded funds, which allow you to invest in a collection of companies sharing similar qualities. She also suggests thinking carefully about how you approach new asset classes, like cryptocurrency. Crypto is such a big asset class now that you shouldn’t ignore it, she said, but you have to be aware that it’s volatile and essentially a speculative gamble.

“Adding even a little sliver can increase the volatility of a portfolio,” she said. She recommends finding an adviser if you have more than $100,000 to manage and to be prudent about new asset classes.

If you’ve been investing on your own, take steps now to examine your portfolio, get educated to improve your financial literacy and make sure you’re on (relatively) solid footing, Crawford says.

“I would start with putting together a globally-diversified mix of assets,” he says. Invest in index funds that capture the global market, then find someone who can educate you.

“Our financial future is one of the most important areas of our life, and very few people spend a meaningful amount of time sorting out, ‘Am I doing the right thing?’” he adds.

Ultimately, it boils down to a simple question he asks investors: When’s the best time to be prudent with your money? “It’s now.”

This article originally appeared in the May/June 2024 issue of SUCCESS magazine. Photo courtesy of CaskX.