With over 20 million downloads, Money Manager has demystified budgeting for the masses. Why has it become a golden child among Mint alternatives? The Money Manager app provides easy content access for both weekly and monthly budgets. It also makes setting and reviewing budgets a breeze with its aesthetically smart interface.

In this Money Manager review, we’ll take a closer look at each of its key features for personal budgeting. You’ll also learn about its main advantages and who can benefit the most from using it.

Key Takeaways

- Money Manager is a leading personal budgeting app in 2024.

- It offers user-friendly visuals that can be tailored to specific aspects of your budget.

- It’s especially helpful for young professionals, families, and entrepreneurs.

Money Manager App Pros And Cons

Money Manager is best for users who want full-picture budgeting. It provides detailed financial reports and multi-currency support. In addition to itemized lists, it offers broader visuals using charts that illustrate asset trends. However, despite its user-friendly tools and highly favorable reviews, this app isn’t flawless.

Pros

- Creates accountability for unwise money habits

- Budgeting is broken down by categories and total budget

- Graphs and visuals are easy to interpret

- A real-time, engaging interface makes budgeting feel compelling

Cons

- Limited to personal, household, or small-enterprise budgeting

- Not a free app

What Are The Key Features Of Money Manager?

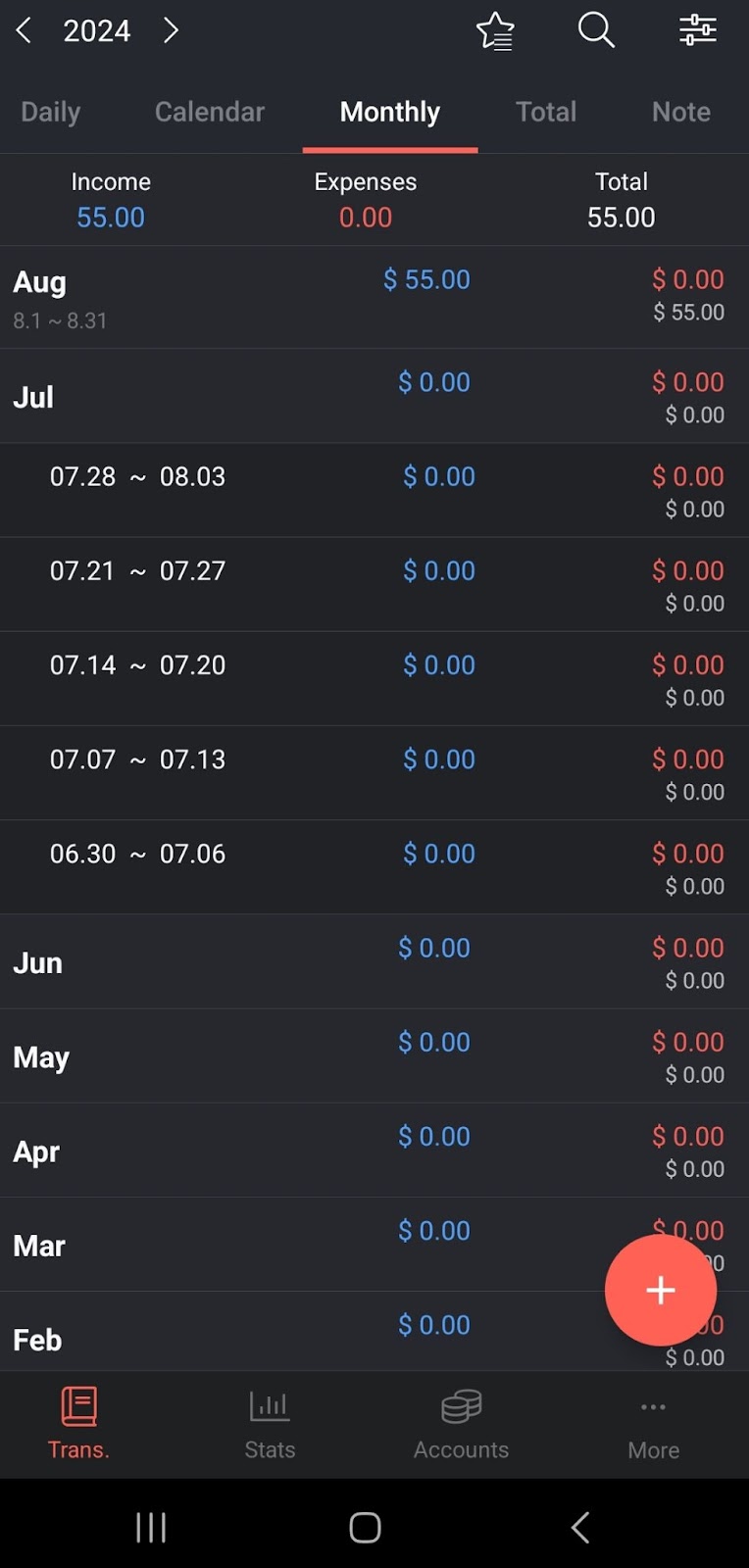

The Money Manager app offers a seamless way to budget thanks to its holistic approach. Its robust suite of features makes it stand out as one of the best financial management tools for 2024. Money Manager also provides “quick glance” spending assessments for each week or month.

Let’s take a closer look at each of its key features to gain further insight.

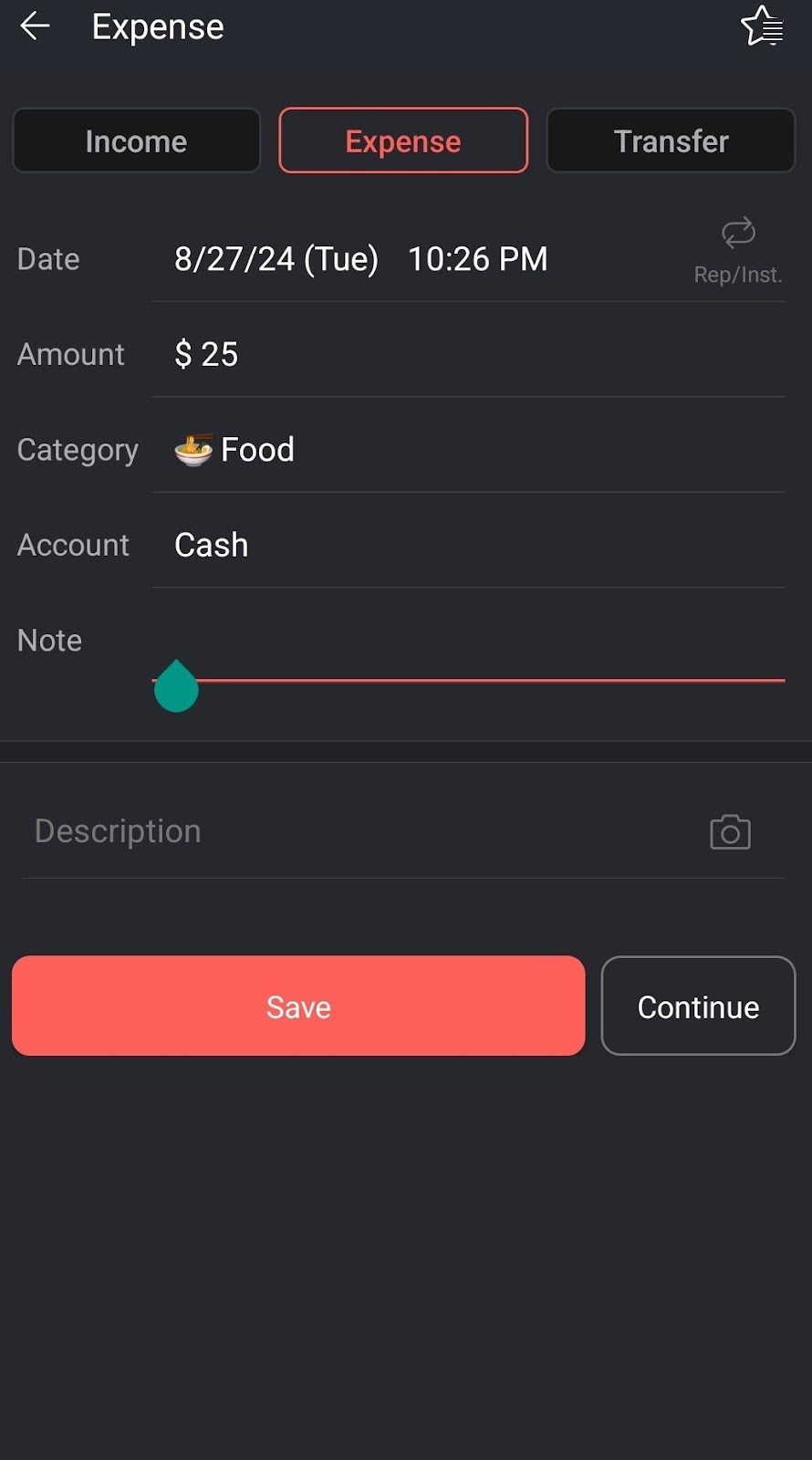

Expense Tracking

Money Manager creates a “slide” for each expenditure. The photo feature lets users save receipts and memories together to create detailed records. Basically, it captures the “what” and “when” of spending. Money Manager also provides color-coded categories to break down spending.

Budget Planning

The Money Manager app allows users to set monthly budgets for each category. Each category includes the percentage spent and the balance remaining. Categories that go over budget are colored red, whereas those under budget are blue. There’s also a reinforced filter for comparing income versus expenses.

Debt Management

Money Manager takes liabilities into account when crafting budgets. Users can hold credit card debt, loan amounts, and other debts against their total budgets. Remaining full balances and current outstanding balances are both recorded.

Investment Tracking

Money Manager provides a portal for managing investments, real estate, and savings. Watching these things grow in comparison to spending can be encouraging. It can also introduce a healthy dose of reality about spending. This is especially the case if the expenditure graphs are eclipsing the growth seen in investment and asset categories.

What Are The Benefits Of Using Money Manager?

At its core, the Money Manager app is a personal aggregator of one’s weekly and monthly spending habits. It removes ambiguity by both recording and synthesizing spending habits and budgets. By seeing where their money is going, people can tweak their habits to stay within budget.

Improved Financial Awareness

The biggest benefit Money Manager offers is providing a place to upload spending habits. Little purchases here and there add up quickly. Getting into the habit of uploading receipts can be an eye-opening change for people struggling with budgeting.

Money Manager provides users with a clear overview of their finances. As they continue to use the app, they can see spending patterns form. This is vital for making conscious financial decisions aligned with long-term goals.

Goal-Oriented Mindset

Money Manager helps users put their goals into action. The creation of reports that compare spending versus income helps foster a goal-oriented mindset. Users can watch the graphs start to align with their goals as their spending habits change. This process can feel highly rewarding, leading to greater confidence and behaviors.

Stress Reduction And Mental Well-Being

There’s a major link between financial worries and psychological distress. At some point, most people have experienced it at a visceral level. While Money Manager can’t solve one’s financial problems overnight, it can help them form healthy money habits.

Research shows that half of adults in the United States lack financial literacy. Money Manager helps people utilize easy-to-interpret visuals to understand their finances. Its features are so user-friendly that nearly anyone can get their finances under control.

Empowerment And Confidence

Money Manager simply turns the information users enter into actionable guidance. One doesn’t have to be proficient in math or accounting to benefit from this app. Its user-friendly features help people gain mastery over finances. This results in greater empowerment and confidence.

The Money Manager app shows users exactly where they stand in terms of income versus monthly expenses. If they need to make a purchasing decision, they can check in with the app’s income-versus-expenses tab. This feature lets them see how close they are to meeting 100% of their spending based on their budget goal.

Who Can Benefit From Money Manager The Most?

Money Manager offers the metrics needed for anyone’s personal, household, and enterprise budgets. While anyone can use the app, there are certain people who are most likely to benefit from its use. Typically this includes young professionals, families, entrepreneurs, and individuals seeking financial wellness.

Young professionals navigating their new careers and living away from home benefit greatly from its use. Convenient uploads and easy tracking help them establish accountability with spending. For families, seeing specific areas of spending is crucial for establishing a household budget.

Finally, being able to factor in assets and investments is especially helpful for entrepreneurs. It helps them create both weekly and monthly analyses, instead of simply focusing on how much they’re spending.

Final Thoughts On Money Manager

The Money Manager app is a comprehensive budgeting app with a simple interface that’s easy to navigate. It’s one of the best apps for inputting spending in real time to create longer-term trend graphs. The app also does a great job of letting users zoom in and out to get full pictures of “macro” and “micro” spending.

While Money Manager can’t replace good spending habits, it can reinforce them. This app helps users make good choices “in the moment,” while factoring in long-term goals and income realities into the backdrop. Consider downloading Money Manager today to pursue a brighter financial future.

Photo credit: Kmpzzz/Shutterstock.com