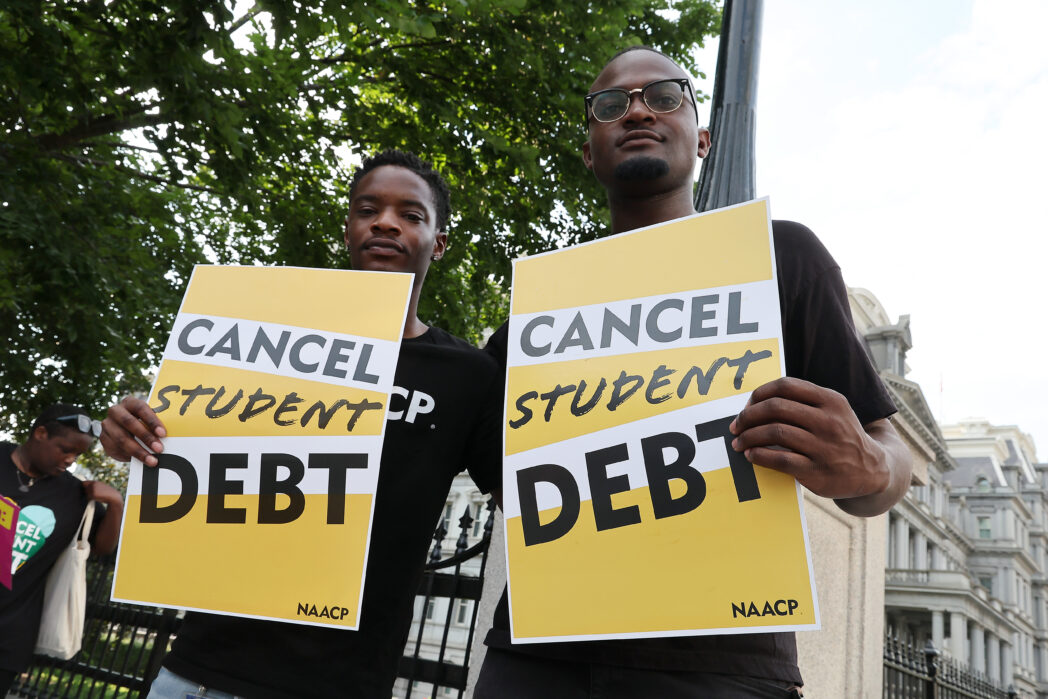

As the Trump administration begins referring defaulted student loan accounts for collections on May 5, advocates for student loan debt relief and cancellation say President Donald Trump’s abrupt departure from Biden-era policies will disproportionately hurt Black borrowers and widen the racial wealth gap.

After more than five years of student loan payment pauses, the Trump administration has escalated the federal government’s attempts to collect payments–all the while Republicans in Congress introduce legislation to eliminate affordable student loan payment programs.

Education Secretary Linda McMahon also made clear that mass student loan debt cancellations issued by President Joe Biden will no longer continue under President Trump.

“The executive branch does not have the constitutional authority to wipe debt away, nor do the loan balances simply disappear. Hundreds of billions have already been transferred to taxpayers,” McMahon said in a statement on April 21. “Going forward, the Department of Education, in conjunction with the Department of Treasury, will shepherd the student loan program responsibly and according to the law, which means helping borrowers return to repayment—both for the sake of their own financial health and our nation’s economic outlook.”

Millions of borrowers in default now face the federal government garnishing funds through tax refunds, salaries (up to 15%), or even social safety net benefits like Social Security payments, reports NBC News. The government said the Office of Federal Student Aid would send notices about wage garnishment later this summer.

But advocates and Democrats warn of a recipe for disaster as the $1.6 trillion student loan debt crisis collides with the continued rising costs in housing and basic goods and services, and concerns of an economic downturn amid President Trump’s tariff policies and plans to extend tax cuts for wealthy Americans.

“As people begin to feel the economic strain, whether it is forcing individuals into default because of student loan payments or removing consumer protection, allowing predatory lenders and others to prey on communities, both Black and white, or the increase of cost of things– we are headed towards recession if this continues,” NAACP President Derrick Johnson told theGrio.

“It is the American people, the workers across this country, who keep this economy going, and so they should have the benefit of economic growth and not being preyed upon by predatory activities, including those predatory activities coming out of the White House.”

Democratic political strategist Ameshia Cross said that as the Trump administration moves to collect on student loans, Black and low-income borrowers, particularly Black women, will suffer most, as they have the “highest student debt burden in the entire nation.”

“On top of that, they had to borrow more on the front end because of a lack of familial wealth, and on the back end, they are now going to be forced to essentially be in a debtor’s prison,” Cross told theGrio. “Going to collections [and] having wage garnishments…means that they won’t be able to pay for child care. That means they won’t be able to pay for housing. That means they will be able to pay for utilities.”

She added, “So there is a downstream effect here that pushes someone into the streets, and this is not hyperbole.”

Cross pointed out that there’s already an affordability issue, as existing student loan plans are still too costly for most borrowers, who have to decide between paying student loans and “keeping the roof over their heads.”

“You are creating a massive destitute population who was only going to college to try to do what we were sold for a very long time, especially millennials– that you would have access to the middle class, that you would have access to the American dream, regardless of your family background or your poverty level or your zip code,” Cross explained. “What Donald Trump is doing is showcasing that that is not true, and he is forcing those people to suffer.”

The Trump administration’s latest move on student loan payments comes as Republicans on Capitol Hill have introduced a plan to overhaul the entire system. According to NPR, the plan would eliminate existing student repayment programs like Income-Contingent Repayment (ICR) and Pay As You Earn (PAYE) plans, and replace them with a “Repayment Assistance Plan.” Republicans also propose ending the Grad PLUS loan program, restricting parent PLUS loans, and forcing colleges and universities to reimburse the federal government for debt when their students fail to repay their loans.

Democratic U.S. Rep. Summer Lee of Pennsylvania slammed the Republican bill during a House Education Committee hearing last week.

“None of the provisions in this bill have any incentives for colleges to lower the cost of admissions. What we are doing instead is incentivizing colleges to take fewer low-income students,” said Lee, who noted that, as a Black millennial first-generation college graduate, people like her would not be afforded the ability to attend college under the newly proposed plan.

The 37-year-old congresswoman called on the U.S. government to invest more in public education, which the country lags behind in compared to other developed nations.

“We cannot simply say that we will take away the opportunities for students to access loans, not replace it with anything else, not replace it with lower college education, not replace them with lower interest rates, not make the system better and still say that you will somehow figure it out,” said Lee.

“We know the outcome here. Black students, brown students, poor students will not be left to figure it out. Instead, elite students, students who come from the 1%, will continue to be able to access education.”

Lee added, “They will continue to have access to career fields…[and[ the achievement gap, the racial gap will just continue to increase because these are not being addressed.”