One thing we can agree on is that managing money can be really challenging. You make a plan, thinking you have it all figured out, but then life happens. Before you know it, you’re scrambling for a quick loan because you overspent. It’s an endless cycle: earn money, spend it, and start over again.

You’re not alone in this struggle. With so many distractions, it’s easy to lose focus on what really matters for financial stability—sticking to a budget. That’s where the YNAB app comes in.

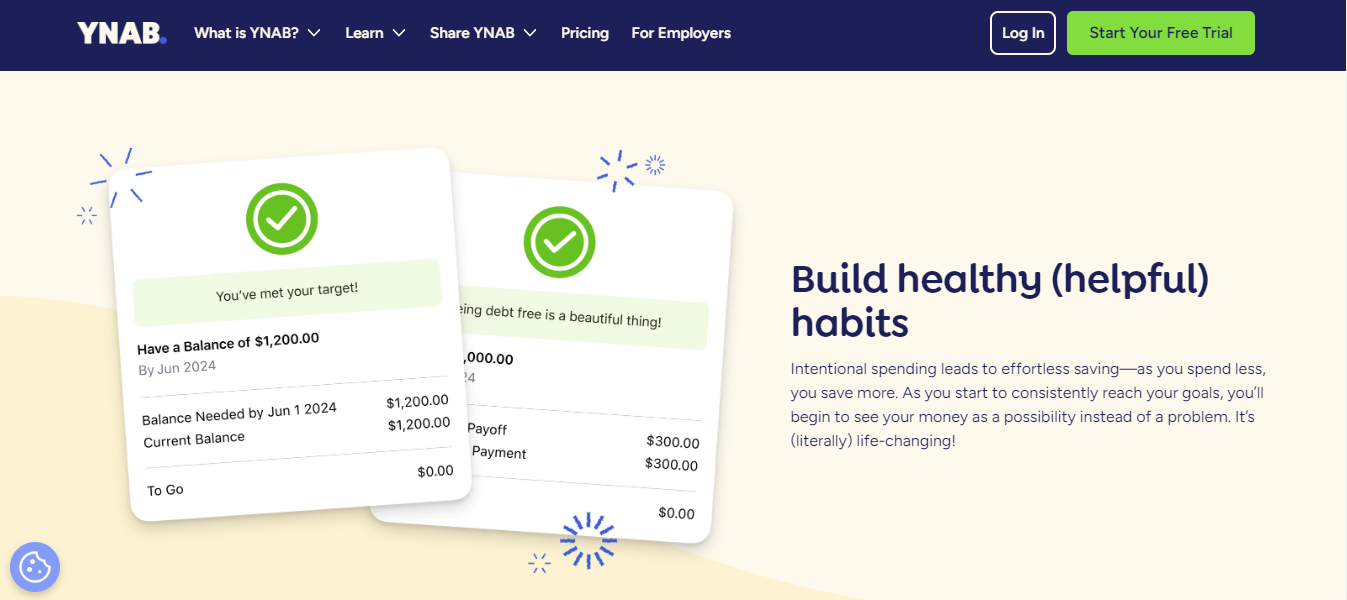

YNAB (You Need a Budget) helps you break free from that never-ending cycle of overspending. Regardless of your earnings, YNAB keeps you on track and makes sure your spending aligns with your financial goals. It helps you look ahead and plan your finances so you’re always in control.

YNAB Is Way More Than Just A Budgeting App

I know, budgeting isn’t exactly the most exciting topic. It’s tempting to think about all the things you could buy or experiences you could have instead of worrying about numbers. But I hate to break it to you—budgeting is just part of adult life, and those numbers aren’t going away. As the saying goes, “A penny saved is a penny earned.” So, while it might not be the most exciting, it’s an important part of managing your money wisely.

Here’s the irony: Why do you have to pay for a budgeting app when all it promotes is budgeting? Why not just save that subscription money and budget yourself? I’d ask the same thing.

However, YNAB is more than a budgeting app. Compared to apps like Mint, YNAB shows that budgeting doesn’t have to be the same old thing. Instead, it can be:

- Customizable to fit your unique financial situation

- A finance planner focused on achieving your financial goals, not just tracking expenses

- Empowering, helping you turn financial challenges into opportunities

The best thing about You Need a Budget is it uses the zero-based budgeting (ZBB) system. If you’re not familiar with it, don’t worry—it’s easier than it sounds. YNAB simplifies zero-based budgeting with its first rule: “Give Every Dollar a Job.”

So, how does this work in real life? With zero-based budgeting, you assign every dollar you earn to a specific task. Let’s say you’re paying bills, buying groceries, adding to your savings, or treating yourself to dinner. Each dollar is assigned to a particular task or spending bucket. YNAB’s method ensures no money is left sitting around or spent on a whim. Instead, you plan in advance and decide exactly where each dollar will go before spending it. This keeps you in control and assures your money is working for you.

This method helps you move from reacting to your expenses to actively managing your money. Instead of being surprised by unexpected costs or wondering where your money went at the end of the month, you’re taking control so your spending aligns with your goals.

What Are YNAB’s Key Features?

By now, you’re probably wondering, “Why not just stick with other budgeting apps like Empower or EveryDollar? What’s in it for me if I decide to use YNAB? And are there features that really set YNAB apart and make it worth the investment?”

Your questions are spot-on, but I’d argue that YNAB is definitely worth considering for its unique features. Here are some key ones that make YNAB a worthwhile investment.

Real-Time Syncing

With YNAB, everything you need is at your fingertips wherever you are. Your phone, tablet, and computer stay updated with your latest transactions and adjustments. If you’re out and about and want to make a quick purchase, you can update your budget on the spot. No more waiting until you get home or worrying about forgetting expenses.

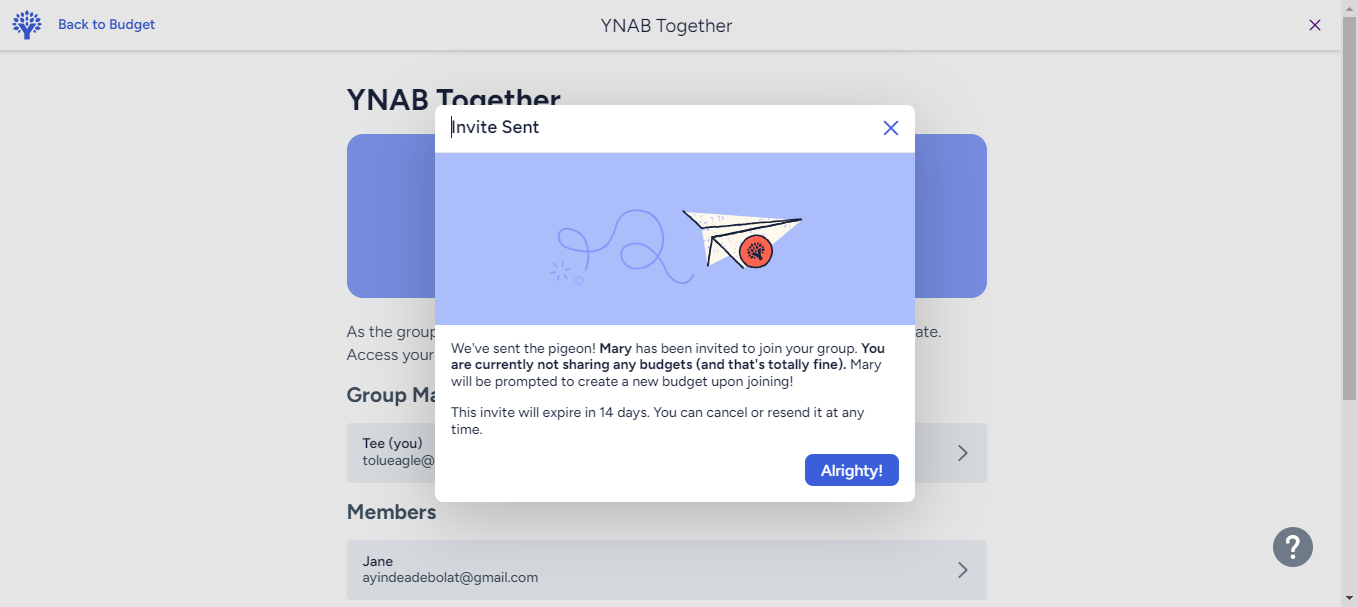

To make managing finances even more enjoyable, YNAB Together lets you team up with your partner or family. Instead of handling everything solo, everyone gets their own secure account to create, plan, and tweak budgets. You’ll stay updated in real time, and if you want, you can share your budget with family members. This ensures everyone is on the same page, leading to more open and positive conversations about money.

This feature helps beyond just planning finances. It can also strengthen your relationships and turn financial management into a collaborative and positive process.

Goal Tracking

Just like a runner needs to stay on course to reach the finish line, tracking your financial goals is key to achieving financial success. YNAB’s goal-tracking feature helps you clarify what you want and keeps you focused on making it happen.

You can set clear priorities and see precisely how much you need to save and how close you are to achieving your personal budgeting goals. No more guessing or guilt—just a straightforward plan for your money.

Tracking your progress becomes easy with visual cues, like color-coded bars that show how close you are to reaching your goals. Whether saving for a down payment on a house, planning a dream vacation, or putting aside money for an emergency fund, YNAB lets you adjust your savings targets as needed. And if life throws you a curveball, you can pause your goals without stress and pick up right where you left off. This way, you’re always moving forward, building healthy habits, and turning your financial dreams into reality.

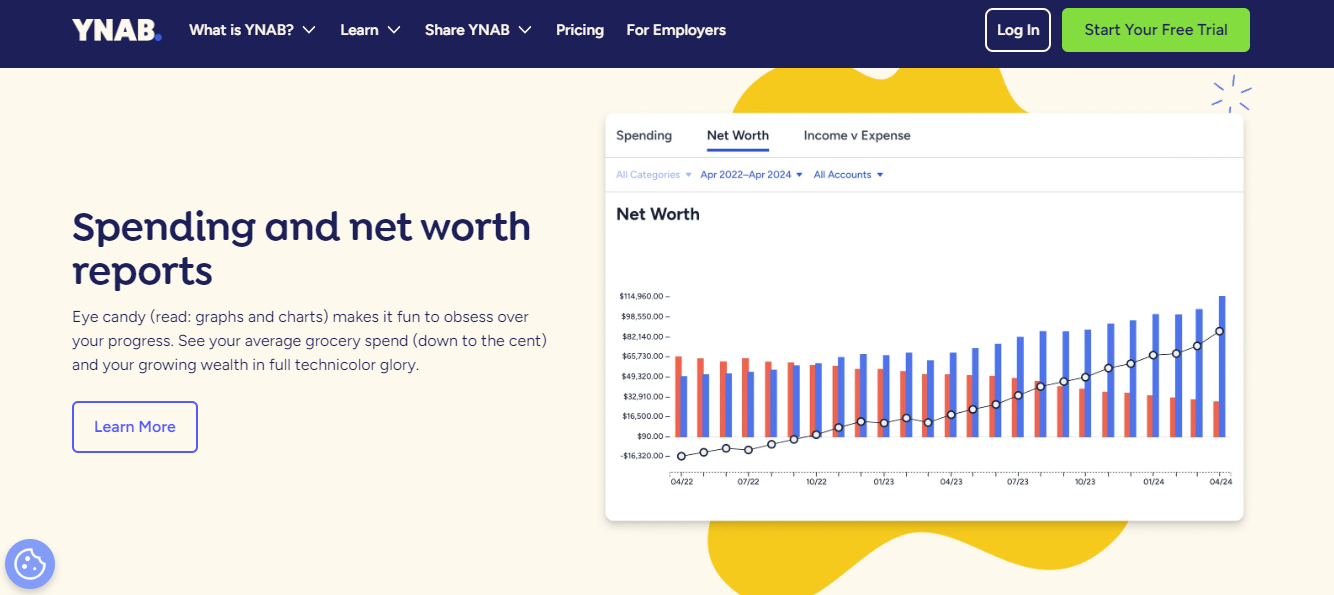

Detailed Reporting

Understanding how you spend your money is critical to managing your finances, and YNAB’s detailed reporting feature makes that easy.

Here’s how YNAB’s reports help you stay on top of your financial game:

- Net Worth Report: Think of this report as a snapshot of your financial health over time. It tracks the balance between what you own (like savings and investments) and what you owe (like credit card debt or loans). For instance, seeing your credit card balance decrease while your savings increase can be incredibly motivating. It shows you’re making progress and that your budgeting efforts are paying off. This report helps you visualize how far you’ve come and encourages you to keep pushing toward your bigger financial goals.

- Spending Report: This gives you a detailed breakdown of your expenses. You can see exactly how much you’re spending in different categories (like groceries, dining out, or entertainment), across various accounts (such as your checking account or credit cards), and over different time periods (like this month or the past year). This breakdown helps you identify spending patterns, spot areas where you might be overspending, and adjust your budget to save more or better allocate your funds.

- Income vs. Expense Report: This report shows how your income stacks up against your spending. It gives you a clear view of whether you’re earning enough to cover your expenses or if you need to make adjustments. This clear comparison shows how your income measures up to your spending and lets you see just how well you’re sticking to your budget.

- Age of Money Report: This shows how many days, on average, your money sits in your budget before you spend it. It gives you a clear view of your cash flow and helps you understand your financial stability. For instance, if you see your money is sitting around longer, it means you’re getting better at managing your finances and can handle unexpected expenses more comfortably.

These reports help you easily identify areas for improvement. They can pinpoint where to focus your efforts and help you take actionable steps to enhance your financial health. This approach makes it simpler to set clear goals, monitor progress, and make adjustments, as needed, to stay on track with financial plans.

The YNAB Method: Four Rules To Financial Success

To fully understand how the YNAB app and its budgeting system work, you must first understand its method. These methods demonstrate that budgeting doesn’t have to be a rigid, one-size-fits-all system. Instead, YNAB’s rules guide you in creating a personalized budget that fits your unique life situation.

Let’s explore these four essential rules and see how they can reshape your approach to budgeting and lead you to financial success.

Rule 1: Give Every Dollar A Job

It might sound a bit far-fetched, but it’s actually quite simple. Think of your money as players on a sports team. Each player (or dollar) needs a specific position and role to contribute to the overall game plan.

Instead of letting your money drift without purpose, assign each dollar a clear task or category—whether paying the bills, saving for that dream vacation, or treating yourself to something special. This way, when you spend, you’ll know exactly how every dollar is helping you reach your financial goals.

This ensures you’re not just managing your money but aligning your spending with your financial goals. No need for extra funds or surprises—just a clear plan, where every dollar has a purpose.

Rule 2: Embrace Your True Expenses

Life is full of surprises, and it’s important to be ready for the unexpected twists. When you’re budgeting, it’s easy to get caught up in the usual monthly stuff, like streaming services, groceries, and your daily coffee runs. But the real challenge is handling those surprise costs, like a sudden home repair or an unforeseen holiday expense. Without any preparation, this surprise can throw your budget off balance.

Rule Two suggests setting aside money each month for these irregular but significant expenses to avoid this. Gradually saving for these expenses prepares you for when they arise, helps to keep your budget on track, and sidesteps any unexpected financial stress.

Rule 3: Roll With The Punches

Flexibility is key in any budget. Life is unpredictable, and sometimes our priorities shift or unexpected expenses surface. The YNAB method encourages you to adapt your budget as needed. If something unanticipated comes up, like a flash sale at your favorite boutique or a last-minute weekend getaway with friends, don’t stress.

Instead, adjust your budget by reallocating funds from less urgent categories. For example, if you’ve set aside money for dining out but then decide to join your friends for a quick trip out of town, you might trim your dining budget for the month to cover the travel costs. Rolling with the punches means your budget evolves with your life, acting as a flexible tool that adjusts to new priorities and unforeseen events rather than a strict set of rigid rules.

Rule 4: Age Your Money

The goal is to make your money last longer, so you’re not just scraping by from one payday to the next. Imagine getting to a point where you’re spending money that’s been sitting in your account for a while. This means creating a financial cushion so your current income is set aside to cover next month’s expenses, giving it time to “age” before you use it.

Start by saving up and gradually building a buffer of one month’s expenses. As you follow the other YNAB rules, you’ll find yourself spending the money that’s been in your account for a while rather than waiting for your next paycheck to cover your immediate needs. This shift allows you to plan ahead, reduces financial stress, and gives you the freedom to make better financial decisions without the pressure of living from one paycheck to the next.

YNAB understands the impact of community, which is why it makes it easy for users to connect. They’ve created a vibrant network where YNAB enthusiasts can come together, share experiences, and support one another on their financial journeys.

With a range of platforms and resources at your fingertips, like YNAB webinars, you can easily find tips, inspiration, and friendly advice from fellow users who are just as invested in the YNAB method as you are.

To connect on social media, check out Facebook groups or Reddit’s active subreddits, like r/YNAB. These platforms make it easy to join conversations, find motivation, and get practical advice from fellow budgeters.

To make things even easier, YNAB has its own YouTube channel packed with budgeting tips. You can also find other channels dedicated to YNAB that offer tutorials and personal budgeting stories, giving you both inspiration and practical insights from real users.

And if you’re feeling confident, you might even consider teaching others about YNAB’s rules and how to make the most out of budgeting.

How Can Using YNAB Help Financial Growth And Self-Improvement?

YNAB has shown itself to be the perfect tool for anyone looking to make the most of their financial life, but it goes even further. It’s also great for helping you build a healthier relationship with money by:

- Shifting your perspective on expenses: YNAB changes how you view expenses. Instead of seeing them as burdens, you start seeing them as proactive steps to avoid future debt.

- Changing your financial mindset: YNAB takes the stress out of managing every penny. With its four rules, you’ll align spending with your goals and values, allowing you to enjoy your choices without guilt. Budgeting becomes a positive, everyday habit, which helps you feel more in control and less anxious about money.

- Helping you become confident about saving: YNAB boosts your confidence in saving. It lets you set money aside with certainty to focus on what matters most without second-guessing your choices.

Boost Your Budgeting Skills With YNAB

It’s perfectly fine if you don’t have everything figured out right away. That’s exactly how YNAB can help. With its four rules, you can tweak your plans and make budgeting work. Progress takes time, and you’ll get there eventually.

Exploring the YNAB app yourself is essential to grasp how it works. The hands-on experience will reveal how easy it is to navigate and how it can aid in achieving financial control. Mastering your finances is crucial for long-term success, and YNAB is designed to help you reach that goal.

YNAB App Frequently Asked Questions (FAQs)

How Do I Begin Using YNAB?

Start by deciding you need a budget. Use YNAB’s resources, such as YouTube videos, live workshops, or the Ultimate Getting Started Guide, to get a handle on the basics.

Is The YNAB App Free?

No, YNAB isn’t free. They offer a free 34-day trial, which gives you enough time to see if it’s a good fit for you. After that, there’s a subscription fee, but many users find the cost is worth it for the budgeting tools and financial insight YNAB provides.

What Are The Pros And Cons Of YNAB?

Pros:

1. YNAB encourages intentional spending by making you actively approve transactions and adjust your budget as needed.

2. The app is highly customizable, which allows you to tailor almost every aspect of your budget to fit your needs.

3. YNAB offers strong educational support with tutorials, live sessions, and a helpful community to guide you.

Cons:

1. YNAB has a steep learning curve, especially for users new to its unique budgeting approach.

2. The app is not free and requires a subscription, which might be a drawback compared to other free budgeting tools.

3. It lacks features like detailed investment tracking and bill paying, so you might need additional tools for complete money management.

How Much Does YNAB Cost?

YNAB is $14.99 per month, with the flexibility to cancel anytime. If you prefer an annual plan, it’s available for $109 per year.

What Does The YNAB App Do?

YNAB gives you control over your money. It’s designed to help you plan ahead, so you’re not just reacting to financial surprises. YNAB helps you be more intentional with every dollar you earn, so you can break free from the paycheck-to-paycheck cycle and start making progress toward your financial goals.

Photo by Prostock-studio/Shutterstock.com